Purpose of this document

The purpose was to work with the founder to dig a little deeper into their idea and bring some formal analysis while helping them see how I break down the process of thinking about a new startup or business idea.

This is not a deep analysis, but rather sits somewhere between an off-the-cuff comment and a full analysis that an associate at a VC firm would do for their investment memo.

Quick Take

The concept is an attempt to reimagine founder education through a gamified simulation powered by AI. The product vision is clear and differentiated, with strong potential for engagement and learning. However, the business side is less convincing. The addressable market is limited, monetisation through consumers will be difficult, and institutional adoption is slow. Revenue forecasts show a viable company but not a venture-scale one, which raises questions about fit with traditional VC. The concept may be better suited to strategic investors, accelerators, or corporates who value impact and steady growth rather than outsized returns.

Startup Idea Summary

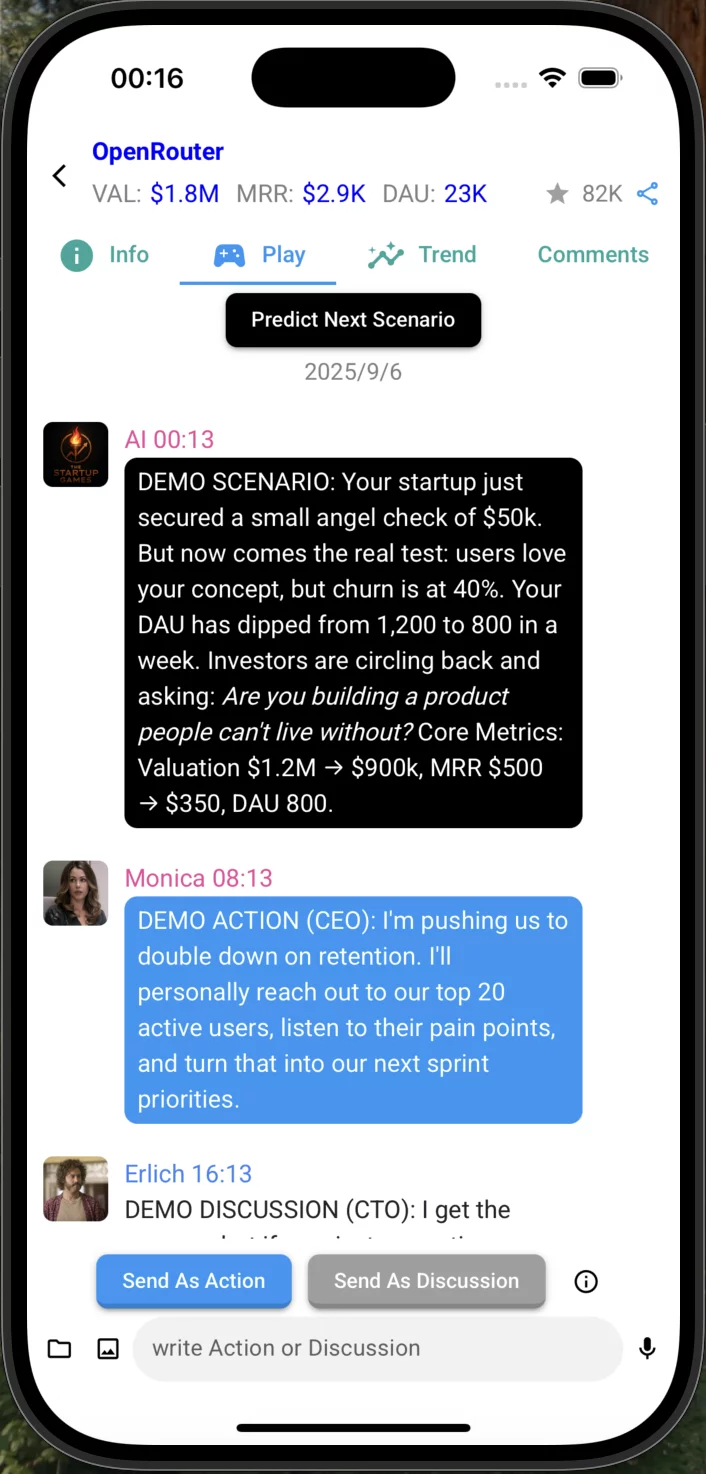

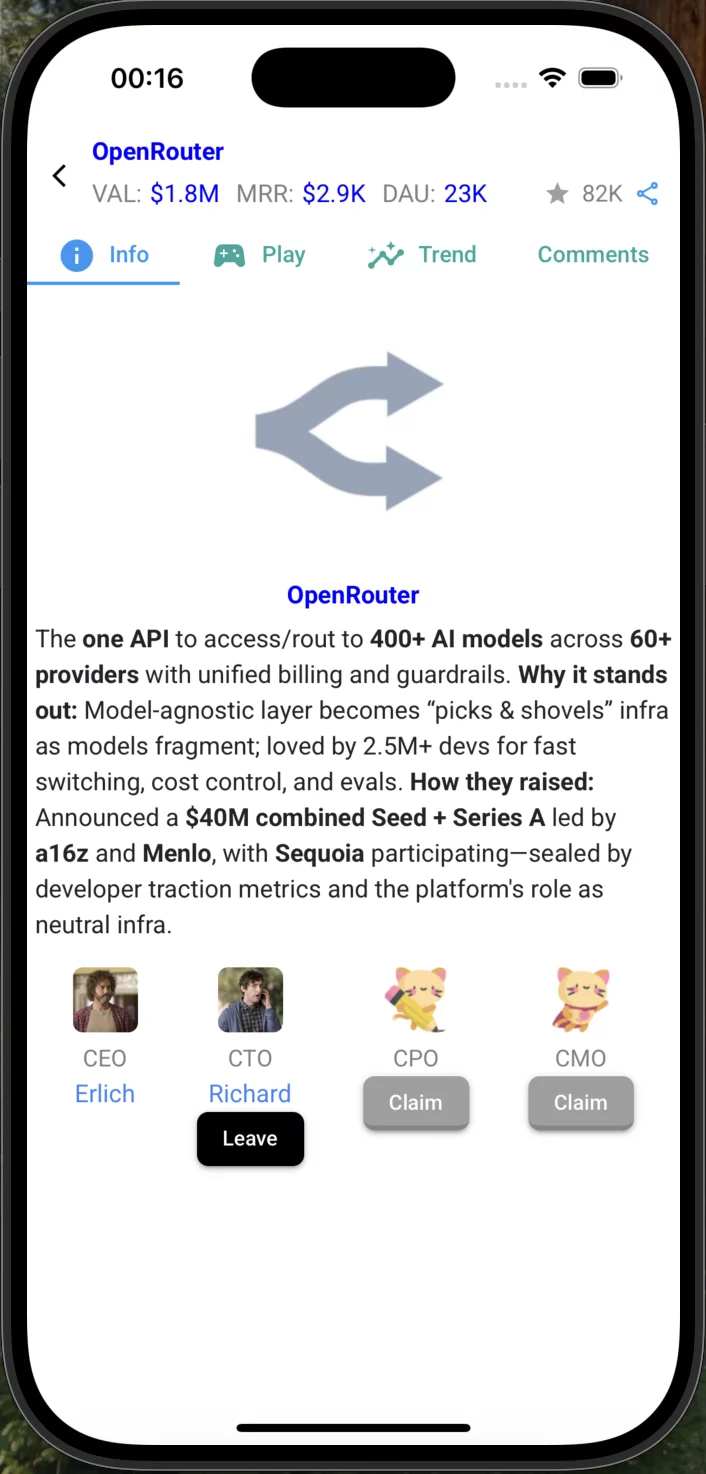

The founder wants to build a gamified simulator powered by a custom-built AI engine. At its core is a rule-based system that generates dynamic scenarios and interactions, combining structured outcomes with randomly generated events. Players take on roles such as founder, investor, or team member and navigate realistic startup situations including fundraising pressure, user retention challenges, and strategic pivots.

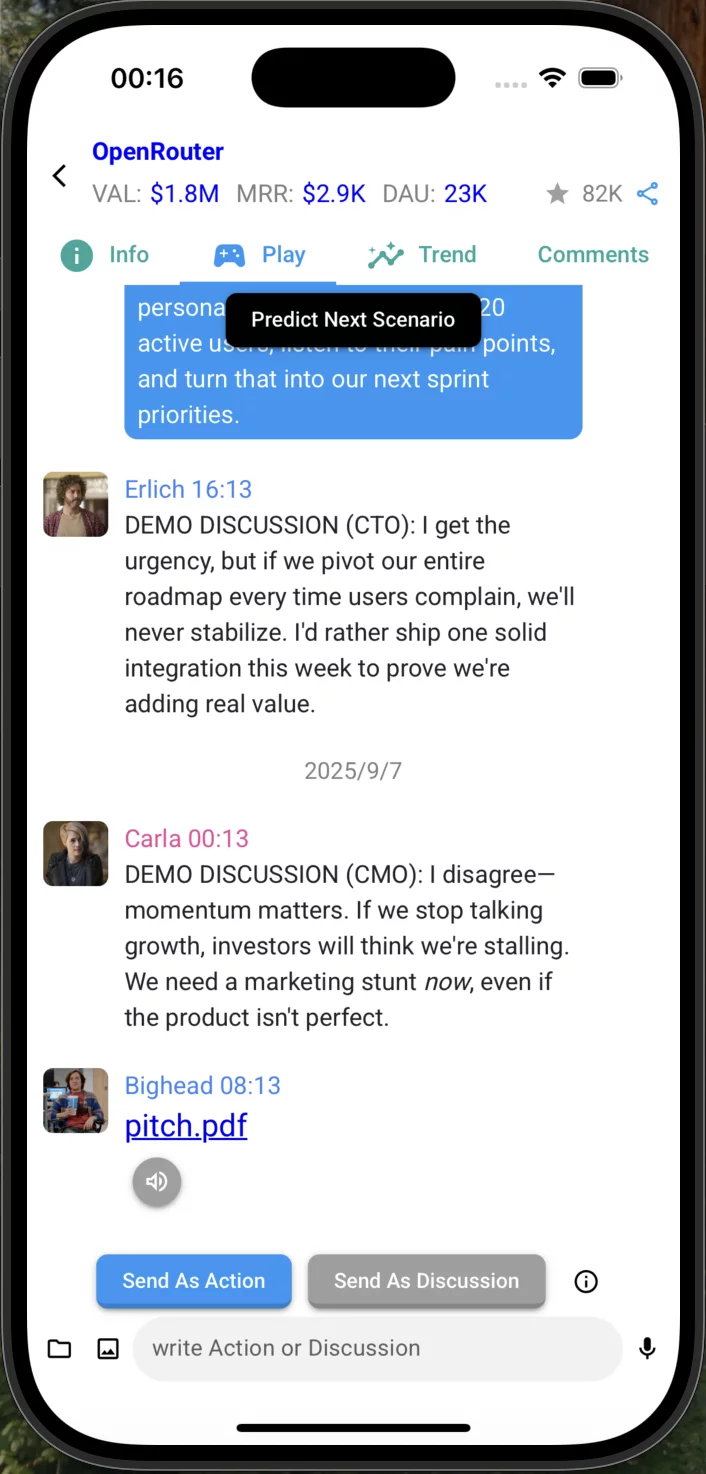

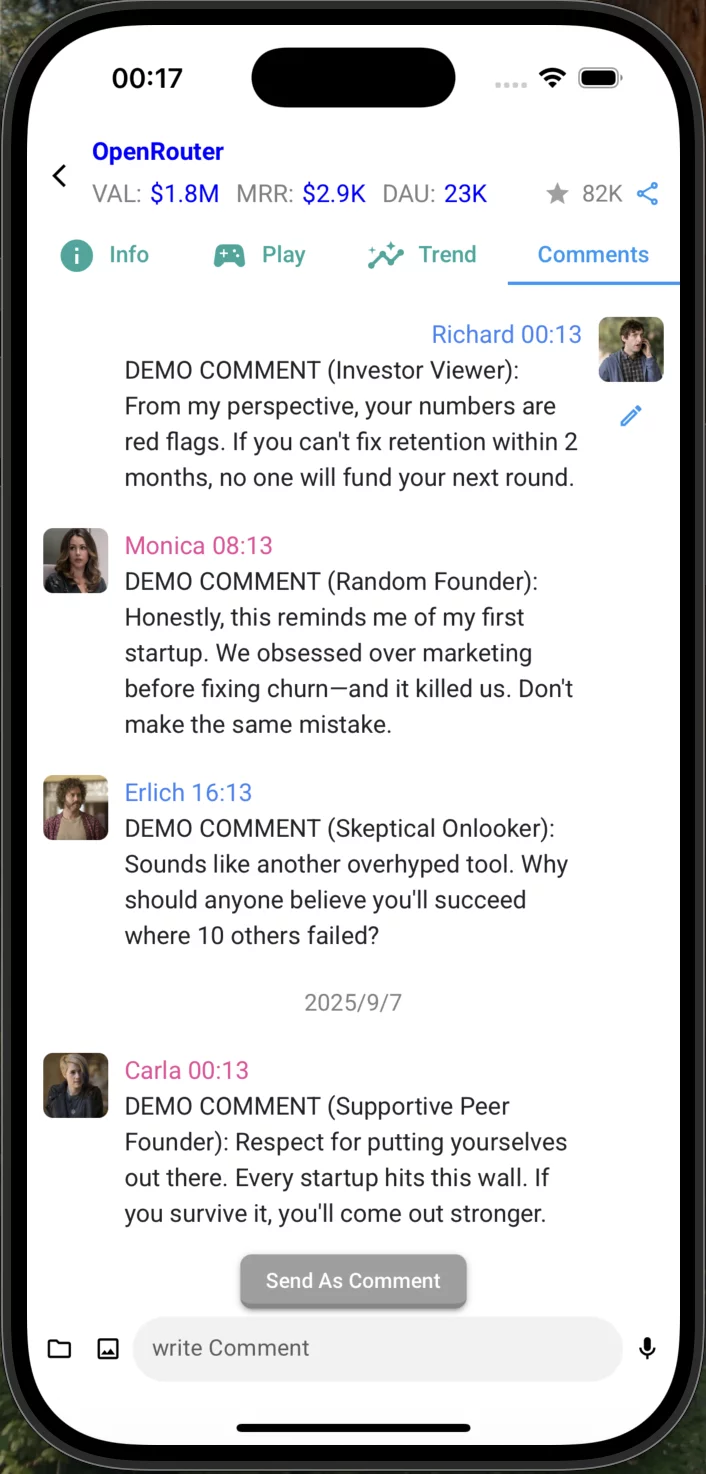

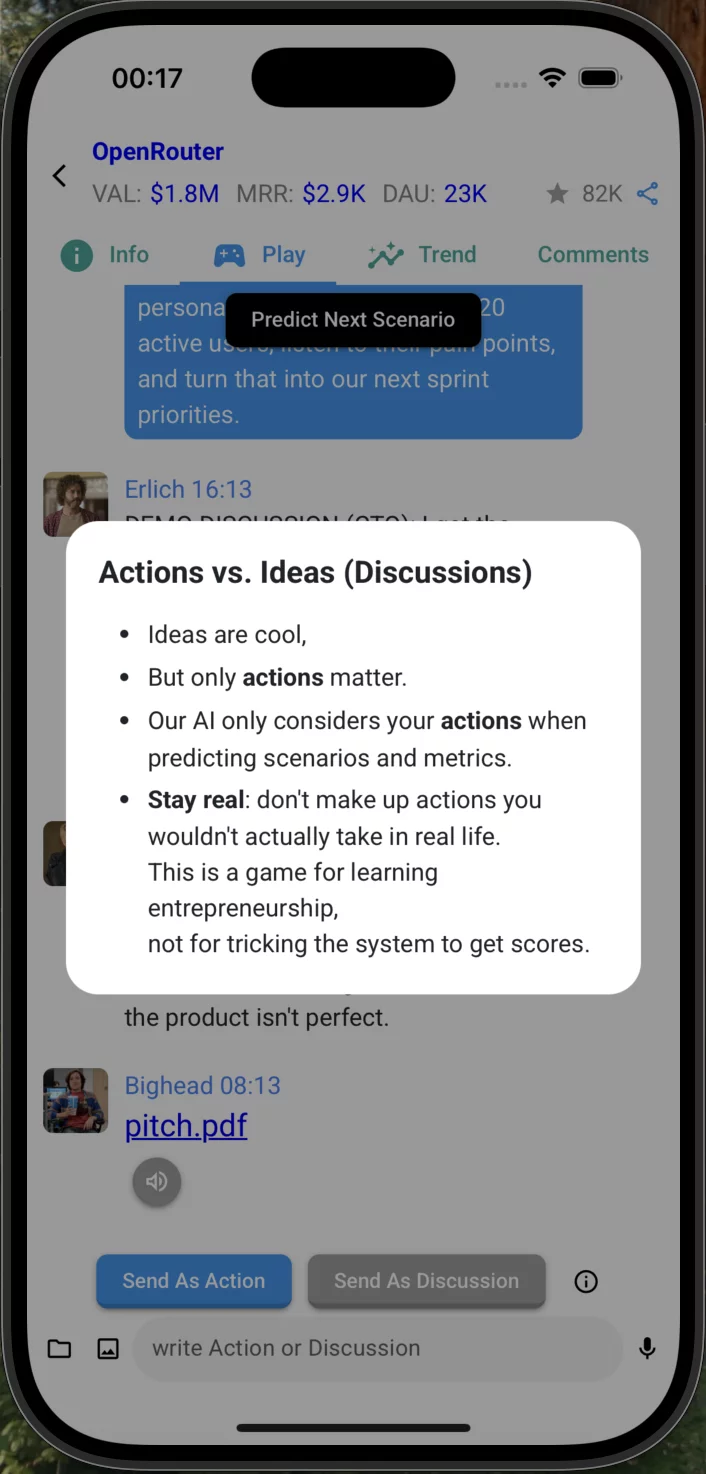

Gameplay blends actions, which directly influence startup metrics like valuation, revenue, and daily active users, with discussions, which capture peer advice, debate, and investor feedback. The AI system ensures that no two playthroughs are the same, creating a balance between structured learning and unpredictable real-world dynamics.

The result is an experiential and social platform where users can practise the realities of entrepreneurship. Unlike traditional business simulations that focus narrowly on financial models, this concept delivers narrative, role-play, and emotional decision-making through AI-driven scenarios that feel authentic and immersive.

What is missing is a stronger case for urgency and necessity. The product vision is clear, but it does not yet answer why this is the right time to launch or whether it solves a must-have problem rather than a nice-to-have gap. The description explains what the product is, but it gives less attention to the business side how it will generate revenue, scale, and become sustainable. Without sharper articulation of why now and why essential, the idea risks sounding more like an interesting concept than a fundable startup.

Vision

When the Founder started his own startup, he discovered firsthand how many new founders lack reliable guidance and structured knowledge. This observation reflects a broader reality: early-stage entrepreneurs often face critical knowledge gaps that undermine their ability to make informed decisions. A 2024 systematic review found that foundational decisions like product strategy, team structure, and market focus are still poorly supported in academic and practical resources, limiting the development of effective tools for founders1.

Financial know-how, in particular, remains a widespread weakness. A recent survey reveals that half of small business owners face fiscal challenges linked to insufficient financial literacy even though 55 percent rate their skills as high. Fifteen percent of respondents had not yet recovered from financial missteps. The implications are serious: gaps in budgeting, cash flow, and metrics interpretation create real obstacles for business survival2.

Taken together, these findings show that founders often venture into building startups with limited support, especially around critical business competencies. This insight lies at the heart of the Founder's vision for this concept, a platform designed to fill that gap by allowing aspiring entrepreneurs to learn through immersive, scenario-based gameplay rather than trial and error.

The Game Concept

Core Gameplay

Players start with a basic idea and limited resources, making strategic decisions across multiple dimensions:

- Product Development: Feature prioritisation, technical debt management, user feedback integration

- Market Strategy: Customer acquisition, pricing models, market positioning

- Team Building: Hiring decisions, equity distribution, culture development

- Fundraising: Pitch preparation, investor negotiations, valuation discussions

- Operations: Resource allocation, scaling challenges, crisis management

Game dashboard concept showing startup metrics and strategic decision points

Game Mechanics

The game incorporates various mechanics to maintain engagement while delivering educational value:

Key Features

- Dynamic Events: Market crashes, competitor actions, regulatory changes

- Resource Management: Capital, time, team capacity constraints

- Networking System: Building relationships with investors, advisors, partners

- Multiple Endings: IPO, acquisition, failure, lifestyle business outcomes

- Real-world Data: Market conditions based on actual industry metrics

AI-driven scenario presentation with decision options

Multi-player team roles and collaboration system

Decision flow showing action consequences and outcomes

Real-time metrics tracking and performance analytics

Networking system for building investor and advisor relationships

Dynamic event system with market disruptions and opportunities

Market Opportunity

Many people worry that the startup market might feel too niche. How many new founders are there, after all? It helps to look at the numbers. Every year, globally, around 50 million new startups are launched that work out to roughly 137,000 new ventures each day3. In the United States alone, over 5 million new business applications were filed in 2023, marking a continuing upward trend that started during the pandemic4.

Still, while those figures are large, they also include a wide range of small businesses, many are side hustles or lifestyle ventures, not necessarily high-growth, venture-scale startups that would engage deeply with this concept. And the reality that only a fraction of new businesses aim at building scalable startups means the highly active, growth-focused founder population is smaller than raw numbers might suggest.

Yet this doesn't weaken the opportunity. In markets like India, the number of formally recognized startups is already approaching 180,000, with over 21,000 new entities added in just the first half of 20255. Plus, regions around the world are doubling down on entrepreneurship ecosystems, for instance the initiative in Maharashtra, India, targets creating 125,000 entrepreneurs and 50,000 new startups over five years6,7.

What these data points reveal is a dynamic and growing pool of aspiring founders and new startups. The core challenge is not the number of startups per se, but creating a product that appeals deeply to this meaningful subset of founders who want immersive, impactful learning tools. The Startup Games, with its narrative-driven simulation and role-based design, aligns squarely with this need. If deeply engaging to even a small percent of new founder cohorts each year, the platform can carve out not just a niche, but a foundational position in edtech for entrepreneurship.

Bottom-Up Calculation

Universities and Business Schools

- Globally there are about 25,000 universities

- Roughly 10 percent (2,500) have entrepreneurship, MBA, or business simulation courses that could adopt a tool like this

- Assume an average licence fee of USD 20,000 per year per institution (covering multiple cohorts and faculty access)

Market size = 2,500 × USD 20,000 = USD 50m annually

Accelerators and Incubators

- Globally there are around 7,000 active accelerators and incubators

- A smaller share will pay for simulation-based training, assume 20 percent adoption (1,400)

- Average fee USD 10,000 per year (smaller budgets than universities)

Market size = 1,400 × USD 10,000 = USD 14m annually

Corporates (Innovation and L&D Budgets)

- Focus on large corporations with innovation or leadership training programmes, around 10,000 companies globally

- Assume 5 percent adoption (500 corporates)

- Average fee USD 50,000 per year for tailored scenario packs and facilitator tools

Market size = 500 × USD 50,000 = USD 25m annually

Consumer Subscriptions (Secondary)

- Assume 100,000 engaged users worldwide (drawn from founder communities, MBAs, and startup enthusiasts)

- Conversion of 5 percent to paid at USD 120 annually = 5,000 × 120 = USD 0.6m annually

TAM (Total Addressable Market)

- Universities: USD 50m.

- Accelerators: USD 14m.

- Corporates: USD 25m.

- Consumers: USD 0.6m.

Total Addressable Market ≈ USD 90m annually

SAM (Serviceable Available Market)

Not all of TAM is realistically within reach in the first 5 years. The more relevant SAM is:

- Universities in regions where English-language edtech is widely adopted, such as North America, Europe, and Southeast Asia, about 1,000 institutions × USD 20k = USD 20m.

- Accelerators that run structured, cohort-based programmes and have budgets for training, around 500 × USD 10k = USD 5m.

- Corporates that already purchase L&D simulations, estimated at 200 × USD 50k = USD 10m.

Combined SAM = USD 35m annually.

SOM (Serviceable Obtainable Market)

This is what The Startup Games could reasonably capture in its first 3–5 years. Assuming:

- 50 universities onboard at USD 20k = USD 1m ARR

- 50 accelerators at USD 10k = USD 0.5m ARR

- 20 corporates at USD 50k = USD 1m ARR

- Consumer subscriptions of 2,000 paid users at USD 120 = USD 0.24m ARR

Total SOM ≈ USD 2.7–3m ARR in a realistic 3–5 year horizon.

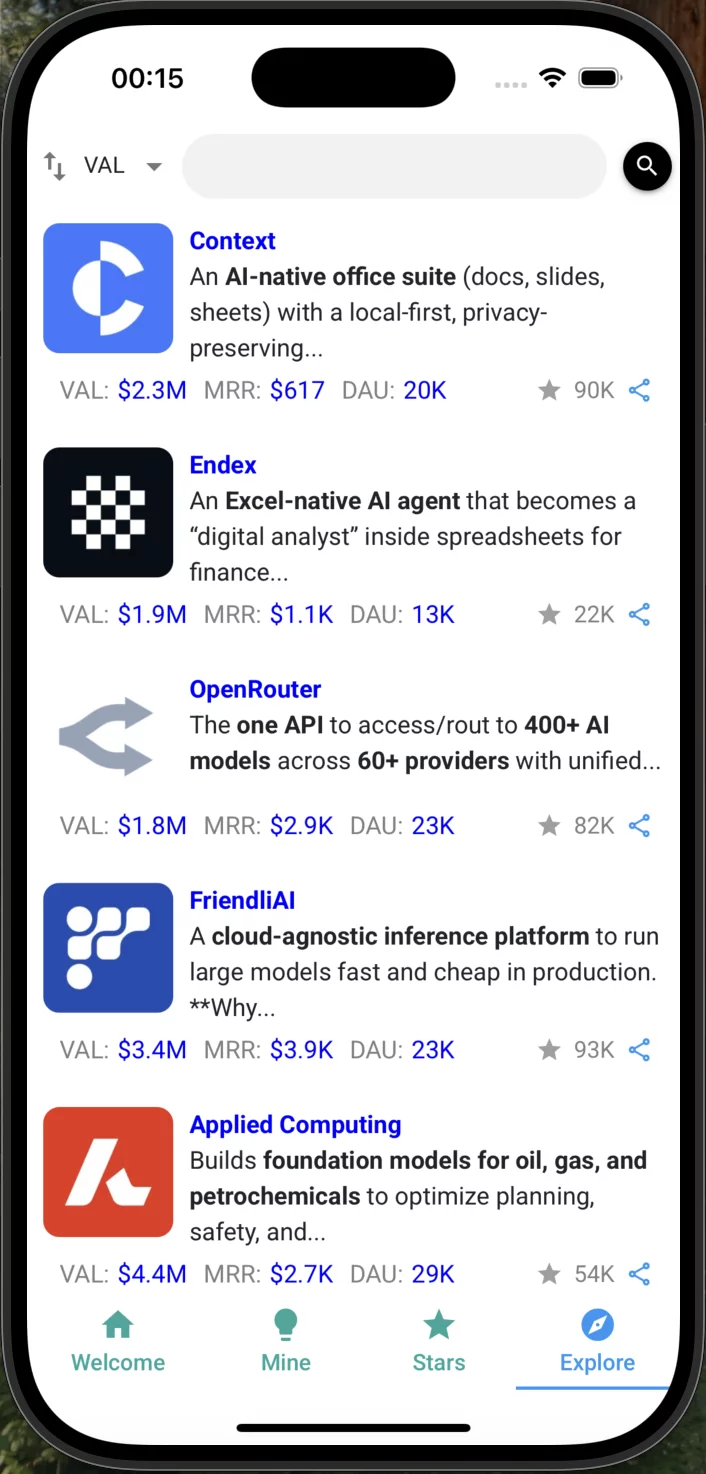

Competitive Analysis

There are several notable platforms in the business simulation space, each delivering distinct strengths but also raising important questions about market dynamics and traction.

Marketplace Simulations powers experiential entrepreneurship, marketing, and strategy games that are often integrated into university curricula. Over 1.5 million students and professionals across more than 700 schools have used their simulations, and their vendor includes instructor support tools, LMS integration, and structured learning scaffolds. The simulations target second- and third-year undergrads through EMBA programs, offering competitive team-based learning with rich metrics and scenario planning8,9,10.

Virtonomics offers a web-based, turn-based multiplayer business simulator. Its ecosystem spans economic modeling, company management, production, R&D, marketing, competition, and even political dynamics. Many users praise its depth and realism, and its startup-focused mode allows players to prototype a company, experience growth challenges, and test strategy execution without real-world risk11.

Markstrat is a flagship marketing strategy simulation developed by StratX. It is used by over 500 academic institutions globally, including many of the world's top business schools. Players manage marketing budgets, product development, market research, and competitive positioning in sequential rounds12.

Other credible platforms like SimVenture Evolution or Intopia tend to emphasize functionality such as business operations, structured curriculum alignment, and teamwork, but lack narrative layers or AI-driven variability. Research indicates that while serious games and simulations enhance learning outcomes for instance, boosting entrepreneurial competence and engagement successful integration depends heavily on curriculum fit, instructor facilitation, and scenario realism13,2,14.

This leads to a critical question: with so many simulations already available, why have few broken through toward broader adoption?

The answer seems to lie in several constraints. Educational simulations are costly and technically complex to develop. Many tools struggle because they do not align deeply with learning needs, or they are too rigid for diverse teaching styles. They often lack strong emotional hooks or replayability, and they may not integrate well into academic or accelerator workflows. As noted in game design research, even well-intended projects falter if they fail on execution or user engagement1.

The Startup Games seeks to overcome this by combining structured gameplay with narrative realism, AI-driven scenario generation, and built-in social feedback. Players step into roles such as founder, team member, or investor, and face randomly generated yet rule-based challenges. They make choices that matter in two ways: metrics-altering actions and discussion-triggering reflections. This multi-layered approach aims to facilitate emotional engagement, learning through immersion, and flexible integration into various learning settings. It positions the platform to offer something that both traditional academic simulations and turn-based strategy games do not currently deliver.

Business & Revenue Model

The Startup Games can draw revenue from a mix of consumer subscriptions, institutional licensing, and corporate partnerships. A freemium model lowers the barrier to entry by offering basic gameplay for free, with premium features such as advanced scenarios or analytics positioned as add-ons. However, it is likely to be very difficult to build a meaningful business around premium upgrades alone. The market of active founders and aspiring entrepreneurs is relatively small, which limits the pool of individuals willing to pay out-of-pocket.

Advertising could supplement this, although the audience size again makes it unlikely to be a major driver. The advantage is that because this is a highly targeted segment, ad performance could be stronger than on broader consumer platforms, potentially yielding better engagement and conversion rates.

The more dependable revenues will come from universities, accelerators, and corporations. These institutions already budget for experiential learning tools and leadership training, and they have the resources to license structured simulations at scale. By tailoring scenario packs and providing facilitator tools, The Startup Games can integrate directly into classrooms, accelerator programmes, and corporate L&D pipelines.

Corporate training offers another opportunity. Many companies invest in intrapreneurship and innovation programmes, and the platform can be marketed as a way to simulate high-pressure decision-making in a safe environment. Sponsored content can also add value, with industry players funding scenario packs that highlight challenges in payments, compliance, or infrastructure.

As the user base grows, in-app purchases such as avatars, cosmetic upgrades, or additional scenario packs can provide incremental income, but they are unlikely to be the main engine of growth. The long-term sustainability will come from positioning The Startup Games as an institutional product rather than relying only on consumers, using licensing and enterprise channels to build recurring and scalable revenue.

Monetisation Strategy

Launch Strategy

The monetisation approach follows a staged rollout to build audience and validate different revenue streams:

- Phase 1 - Consumer Launch: Focus on direct-to-consumer sales to build user base and gather feedback

- Phase 2 - Educational Partnerships: Develop relationships with universities and business schools

- Phase 3 - Enterprise Expansion: Scale to corporate training market with premium features

Pricing Considerations

Consumer Pricing: Competitive with premium indie games while reflecting educational value

Educational Pricing: Per-student licensing model similar to other educational software

Enterprise Pricing: Value-based pricing reflecting training cost savings and outcomes

Go-To-Market Strategy

The first priority is to build credibility and engagement within the founder community. Early adoption will be driven by working with accelerators, incubators, and university entrepreneurship programmes. These organisations are already looking for ways to make founder education more experiential, and The Startup Games can be positioned as a lightweight, engaging tool that complements workshops and courses. Offering free pilot access or sponsored sessions will help generate initial case studies and testimonials.

Alongside institutional partnerships, the product can be seeded into existing founder networks. Founder communities on LinkedIn, Slack, and Discord, as well as student entrepreneurship clubs, are natural entry points. A referral system where users invite peers to join their startup "teams" can create organic growth loops, since the game is inherently social.

Content marketing will play a role in building authority. Scenario highlights, playthrough snippets, and "what would you do" founder dilemmas can be shared across social media to spark engagement and curiosity. This also positions the game as both a learning tool and a conversation starter within the startup ecosystem.

Corporate innovation teams represent the next tier of outreach. Many companies run intrapreneurship challenges and leadership development programmes. By tailoring scenario packs to corporate needs, The Startup Games can expand into enterprise learning budgets.

The GTM focus, therefore, is not on mass consumer acquisition but on targeted distribution into communities where startup education is already taking place. Accelerators, universities, and corporations provide concentrated audiences with both need and budget. Consumer usage remains important for virality and community building, but the revenue and scale will come from institutional and enterprise adoption.

Key Metrics

The Startup Games will need to demonstrate traction through usage, engagement, and institutional adoption.

At the product level, the focus will be on daily active users, session length, and repeat play rates. A healthy benchmark is to reach 5,000 monthly active users within the first year, with at least 30 percent of users returning weekly. Average session length should trend toward 15–20 minutes, showing that players are engaging with full scenarios rather than dropping out early. Scenario completion rates above 60 percent will suggest that the gameplay loop is compelling.

Growth metrics will come from the number of startups created inside the platform, the number of roles filled per startup, and referral-driven sign-ups. A realistic benchmark is 500 startups created per month by the end of year one, with at least two additional users invited for every new startup created. This will confirm that social mechanics are driving organic growth.

For institutional adoption, early traction will be measured by pilot partnerships. The target is 5–10 universities or accelerators in the first year, expanding to 25–30 institutions by year two. Each institution should ideally run 2–3 cohorts per semester with an average cohort size of 30–50 participants, which provides a path to recurring revenue.

On the revenue side, the goal is to achieve an initial ARR of USD 500,000 by year two, driven primarily by institutional licensing. Consumer revenue will be incremental, with a realistic benchmark of 5 percent conversion from free to paid tiers in the first year of premium features.

In the longer term, impact metrics will matter as much as scale. Post-simulation surveys should show at least 70 percent of players reporting improved confidence in startup decision-making. Institutions will expect evidence of measurable learning outcomes, which will help with renewals and expansion.

Strategy & Roadmap

The strategy is to establish The Startup Games first as a credible learning tool for early founders, then expand its reach into institutions and enterprises. The roadmap follows a phased approach that balances product maturity with market adoption.

Phase 1: Prototype and Validation (0–2 months)

Build the core AI-driven game engine and release a closed prototype. Test with a small group of founders and students to validate gameplay mechanics, scenario quality, and replayability. Early pilots with one or two accelerators or university programmes will provide initial case studies.

Phase 2: Closed Beta and Community Building (2–6 months)

Launch a closed beta with broader access. Focus on engaging founder communities, student entrepreneurship clubs, and accelerator cohorts. Add referral and team-formation features to encourage viral growth. Begin generating early data on session length, retention, and startup creation rates.

Phase 3: Institutional Rollout (6–18 months)

Expand pilots into structured partnerships with accelerators, universities, and incubators. Develop facilitator dashboards and custom scenario packs to make integration seamless. Secure 5–10 institutional customers and run multiple cohorts per semester.

Phase 4: Enterprise Expansion (18–30 months)

Introduce tailored scenario packs for corporate innovation and leadership programmes. Target intrapreneurship teams and corporate L&D budgets. Position The Startup Games as a scalable training platform that complements existing innovation frameworks.

Phase 5: Scale and Secondary Revenue (30 months onward)

Grow institutional partnerships beyond 30 universities and accelerators. Expand enterprise customers, add sponsored content from industry partners, and refine monetisation through licensing and secondary revenue streams. Use accumulated data to publish benchmark reports on founder decision-making, positioning the platform as both an educational tool and a knowledge base.

Financial Forecast

The model assumes that revenue will come primarily from institutional licensing and corporate partnerships, with consumer subscriptions and in-app purchases contributing only marginally.

Year 1 (Prototype and Closed Beta)

The priority is product development and pilot validation, not revenue. Costs will be concentrated on engineering, scenario design, and partnership development, estimated at USD 400k–500k for the year, covered by the pre-seed raise. Revenue is expected to be negligible, limited to small pilot fees.

Year 2 (Institutional Rollout)

The first real revenue arrives from early institutional licences. The target is 5–10 universities or accelerators, each paying USD 15k–25k annually, which brings in USD 100k–200k. A consumer conversion of 5 percent of 10,000 MAUs at USD 10 per month could add another USD 60k ARR. Combined, the revenue target is USD 200k–300k ARR.

Year 3 (Enterprise Expansion)

With validation in place, expansion into corporate innovation budgets begins. The goal is 25–30 institutions paying USD 25k annually and 5–10 corporates paying USD 50k–75k annually, for a total of USD 1.2m–1.5m ARR. Consumer subscriptions may add USD 200k ARR, but institutional and enterprise deals will remain the growth driver.

Year 4 and beyond (Scale and Secondary Revenue)

The path forward is to scale to 50+ institutions and 20+ corporates, reaching USD 4m–6m ARR. Sponsored content and secondary streams such as branded scenario packs can supplement this, while operating leverage improves as costs are largely frontloaded in development.

These forecasts, however, raise a structural concern. From a venture capital perspective, a business reaching USD 5–6m ARR in four years is unlikely to deliver the 20x return profile that most funds target. Even with strong execution, the revenue potential points to a company that may be valuable, but not "venture scale" in the traditional sense. This could make The Startup Games difficult to fund through mainstream VC, and instead suggest a better fit with strategic investors, accelerators, or alternative funding routes that value impact, education, or corporate alignment over outsized financial multiples.

The Team

Founder Profile

Background & Experience

The founder serves as CTO of The Startup Games and is currently co-founding a Singapore-based startup since 2021. Previously worked as a Research Assistant at a top-tier university, focusing on applied physics and molecular biophysics.

Education

- BSc in Physics from a globally ranked university (top 10 worldwide)

- Exchange programme in Molecular Biophysics at a European research university

Motivation & Vision

The founder brings a scientific and analytical approach to startup building, combining physics training with entrepreneurial drive. Current startup experience provides firsthand insight into the founder journey, which informs the realism of The Startup Games.

Relevant Skills & Expertise

- Startup operations and product development (via current venture)

- Strong research and analytical background

- Technical leadership as CTO

- Cross-cultural and international exposure

Fit for The Startup Games

The founder's unique blend of scientific rigour, entrepreneurial experience, and product leadership equips them to design a simulation that is both realistic and educational. Their own founder journey provides authentic context to the game's scenarios, especially around challenges like raising capital, retention, and pivots.

Team Weaknesses

As a first-time founder building in education technology and gaming, the founder does not yet have a track record of scaling a venture-backed business. Their background is rooted in physics and research, which brings analytical rigour but less exposure to commercial go-to-market execution. While current startup experience provides valuable insight, they have not yet proven success in acquiring large institutional customers or navigating the enterprise sales cycle.

Another limitation is team depth. At this stage the founding team is small, and there is no clear commercial co-founder or senior operator with experience in scaling B2B SaaS or enterprise education products. This may slow progress on revenue generation and partnerships if not addressed early.

These weaknesses are not unusual at the pre-seed stage, but they highlight the importance of surrounding the founder with experienced advisors, early hires, and possibly co-founders who can complement their technical and product vision with commercial and operational expertise.

Risk Factors & Mitigation

Small addressable market

The number of active founders and aspiring entrepreneurs is meaningful but not massive. This creates a ceiling for purely consumer-driven growth. Mitigation comes from focusing on institutions and corporates, where budgets and cohorts aggregate demand. Universities, accelerators, and L&D teams can deliver recurring revenue without relying on consumer volume.

Monetisation challenges

Consumer willingness to pay for premium features is likely to be low. Ad revenue may also be limited by audience size. Mitigation is to treat consumer monetisation as secondary and instead prioritise licensing to institutions, corporates, and sponsors, which offers higher-value contracts.

Funding risk

The financial forecast suggests a revenue trajectory that may not meet venture capital expectations for a 20x return. This could make the company unfundable by traditional VC. Mitigation is to target strategic investors, corporate partners, and education-focused funds who value impact and steady growth rather than pure venture-scale returns.

Content and replayability

A simulation without fresh content risks becoming stale. Mitigation comes from the custom AI-driven scenario engine, which can generate varied and unpredictable challenges, and from enabling user-generated or partner-created scenario packs to keep the platform fresh.

Competitive landscape

There are several existing simulation platforms, and some have struggled to gain traction despite well-designed products. Mitigation is to differentiate through emotional realism, role-play mechanics, and AI variability, delivering a more engaging experience than traditional financial or operational simulators.

Adoption barriers in education

Universities and corporations can be slow to adopt new tools, particularly if they require integration into curriculum or training structures. Mitigation is to build facilitator dashboards, keep the product lightweight, and start with pilots that can be adopted quickly before pushing for long-term contracts.

Execution risk

As with any early-stage product, the challenge is turning a strong concept into a polished, usable platform. Mitigation lies in keeping the initial scope narrow, validating the core gameplay loop, and proving value in early pilots before scaling.

My Investment Thesis

The Startup Games is tackling a real gap in founder education. Most new entrepreneurs do not have access to structured, realistic training, and existing simulations miss the emotional and social side of building a company. The product's AI-driven scenario engine, combined with role-play and community feedback, creates a more authentic and engaging way to practise the founder journey.

The founder brings credibility through their background at top-tier universities and hands-on startup experience. Their own exposure to the knowledge gaps and struggles of early founders provides authenticity to the product vision.

The business model makes sense in principle. Institutional licensing and corporate partnerships are proven channels in edtech, and universities and accelerators are already looking for tools to make founder training more experiential. Consumer adoption will drive community and virality, but the real revenue will come from secondary channels like institutions and corporations.

The concern is scale. Even with solid execution, the financial trajectory may not deliver the kind of returns venture capital usually requires. ARR in the single-digit millions by year four will not excite VCs who are looking for 20x outcomes. This raises the question of whether the company is truly venture-backable, or whether the better path is to pursue strategic investors, corporate partners, or education-focused backers who value impact and stable returns.

In short, this is a smart and well-timed idea with a differentiated product. It can create meaningful impact and generate healthy, steady revenues. But it may never reach the growth profile that mainstream VC demands.

Valuation & Raise Details

The founder is seeking a USD 500k to 750k pre-seed raise, targeting 10 to 20 percent ownership post-money. This implies a post-money valuation range of USD 2.5m to 7.5m, but of course this would be driven by the market and the valuation offered by the VCs.

The founder is also open to a smaller round focused on building out the concept further and using the enhanced product to attract a co-founder with complementary commercial skills. This alternative approach would prioritise team building and product validation over immediate scale.

The cap table after the raise would be structured as follows:

- Founders: 70–80 percent

- Investors (pre-seed): 10–20 percent

- ESOP: 10 percent reserved for early hires

This raise is designed to provide around 18 months of runway, enough to complete product development, run pilots with universities and accelerators, and begin institutional sales.

Funds will be allocated broadly as follows:

- Product development and engineering: 45 percent to complete the AI game engine, build out scenario libraries, and support ongoing iteration.

- Content creation and scenario design: 20 percent to ensure a strong and varied set of challenges for players.

- Go-to-market and partnerships: 20 percent to run pilots, build institutional relationships, and support marketing into founder communities.

- General operations and overhead: 15 percent to cover legal, compliance, and basic administrative costs.

The structure balances investor participation with strong founder control and creates room to attract early team members through the ESOP. The question remains whether this valuation and raise size will appeal to mainstream VC. Given the projected revenue profile, the company may not meet the 20x return profile that traditional funds expect. The round is better suited to strategic investors, accelerators, or education-focused funds that value impact and measured growth.

Exit Paths

There are three likely exit routes for The Startup Games.

Acquisition by an EdTech platform

This represents the most likely and strategically aligned exit path. Major EdTech platforms are actively seeking to differentiate their offerings and move beyond traditional video-based learning towards more interactive, experiential formats.

Strategic Rationale

Companies like Coursera, Udemy, and LinkedIn Learning face increasing competition and commoditisation of online courses. Adding a simulation layer to their entrepreneurship and business courses would create a premium offering that justifies higher price points. The Startup Games would plug directly into their existing course catalogues, particularly MBA-level content, entrepreneurship specialisations, and corporate training programmes.

For platforms like MasterClass, which already positions itself as premium content, The Startup Games could complement their existing business and leadership classes by providing hands-on application of concepts taught by their instructors. This transforms passive learning into active practice.

Potential Acquirers and Rationale

- Coursera: Already partners with universities globally and has strong B2B relationships. The Startup Games would enhance their business school offerings and provide a differentiated experience for corporate clients.

- LinkedIn Learning: Perfect strategic fit given LinkedIn's professional focus. The simulation could integrate with LinkedIn's networking features, allowing users to connect with other "founders" from their cohorts.

- Udemy Business: Focused on corporate training market. The Startup Games would add a premium, interactive component to their entrepreneurship and innovation training offerings.

- Pearson: Major textbook and educational content publisher looking to modernise. Could integrate The Startup Games with their business school textbooks and digital learning platforms.

Valuation Considerations

EdTech acquisitions typically trade at 5-15x revenue multiples, depending on growth rate and strategic value. Given The Startup Games' projected USD 4-6m ARR by year four, this suggests a valuation range of USD 20-90m. The higher end would require demonstrating strong engagement metrics, institutional adoption, and clear synergies with the acquirer's existing platform.

Strategic value could push valuations higher if The Startup Games demonstrates unique capabilities around AI-driven personalisation, community engagement, or measurable learning outcomes that the acquirer cannot easily replicate.

Acquisition by a corporate training or consulting firm

This exit path offers compelling strategic value, particularly as corporations increasingly focus on innovation, intrapreneurship, and developing entrepreneurial thinking within their organisations.

Strategic Rationale

Management consulting firms and corporate training providers face pressure to deliver measurable outcomes from leadership development programmes. The Startup Games provides a controlled environment where executives can practise high-stakes decision-making, experience failure safely, and develop entrepreneurial mindsets without real business consequences.

For consulting firms, this creates a differentiated training offering that goes beyond traditional case study analysis. Clients can experience the emotional reality of startup challenges, making lessons more memorable and applicable to corporate innovation initiatives.

Potential Acquirers and Rationale

- McKinsey & Company: Could integrate The Startup Games into their leadership development programmes and innovation consulting practice. Particularly valuable for their work with corporate venture capital arms and innovation labs.

- Boston Consulting Group (BCG): Strong focus on digital transformation and innovation consulting. The Startup Games would complement their existing digital learning platforms and innovation methodologies.

- Deloitte: Large corporate learning division with established relationships across industries. Could package The Startup Games as part of their leadership development and digital transformation offerings.

- Corporate Universities (GE Crotonville, McDonald's Hamburger University): Internal corporate training organisations seeking innovative approaches to develop entrepreneurial leadership capabilities.

- Specialist L&D Providers (Dale Carnegie, Franklin Covey): Looking to modernise their curriculum with interactive, technology-driven learning experiences.

Value Proposition for Acquirers

Corporate training acquisitions are often valued based on the ability to scale existing client relationships and create recurring revenue streams. The Startup Games would allow acquirers to:

- Charge premium rates for experiential learning programmes

- Extend engagement with existing clients through multi-cohort implementations

- Differentiate from competitors offering only traditional training methods

- Develop proprietary IP around entrepreneurial leadership development

Valuation Considerations

Corporate training and consulting acquisitions typically trade at 3-8x revenue multiples, lower than pure EdTech but with more predictable enterprise sales cycles. Strategic value could be significant if the acquirer can demonstrate improved client outcomes and retention through simulation-based learning.

The key differentiator would be proving measurable impact on client innovation programmes and leadership development initiatives, which could justify premium valuations in the USD 15-50m range for a business generating USD 4-6m ARR.

Acquisition by a gaming or simulation publisher

This represents the most technically aligned exit path, where acquirers would primarily value the AI-driven game engine, content creation capabilities, and proven engagement mechanics rather than educational distribution channels.

Strategic Rationale

Serious games and simulation publishers face challenges in creating compelling content that balances entertainment with learning outcomes. The Startup Games demonstrates a successful formula for narrative-driven, AI-powered scenarios that maintain engagement while delivering measurable educational value.

Gaming publishers increasingly recognise the value of the "serious games" market, particularly as corporate training budgets shift towards more engaging, interactive formats. The Startup Games provides a proven template that could be adapted for other professional development areas such as leadership, sales training, or project management.

Potential Acquirers and Rationale

- Serious Game Studios (Learning Games Network, Designing Digitally): Specialist developers looking to expand their portfolio with proven IP and enter the entrepreneurship education vertical.

- Educational Publishers (Houghton Mifflin Harcourt, McGraw-Hill): Traditional textbook companies seeking digital transformation and interactive learning capabilities.

- Simulation Companies (AnyLogic, Simio): Technical simulation providers wanting to add gamified, user-friendly interfaces to their enterprise offerings.

- Gaming Publishers with Educational Focus (PlayMob, Filament Games): Companies bridging entertainment and education, seeking established content in the business/entrepreneurship niche.

Technical and IP Value

For gaming acquirers, the core value lies in the AI engine that generates dynamic, realistic business scenarios. This technology could be repurposed for:

- Corporate training simulations across different industries

- Academic business school curricula and case study platforms

- Consumer entertainment games with business/management themes

- White-label simulation platforms for other educational publishers

Market Position and Growth

The serious games market is projected to reach USD 24.5 billion by 2030, with corporate training representing the fastest-growing segment. An acquirer could leverage The Startup Games' proven engagement model to capture a larger share of this expanding market.

Valuation Considerations

Gaming and simulation acquisitions often trade at lower multiples (2-6x revenue) than pure EdTech, but with potential for higher growth through content licensing and white-label opportunities. The technical IP around AI-driven scenario generation could justify premium valuations if it demonstrates broad applicability beyond entrepreneurship education.

Strategic value would be highest for acquirers seeking to establish a platform play, where The Startup Games becomes the foundation for multiple simulation products across different professional development verticals.

A less likely but possible path would be an IPO in the long run, if the product evolves into a large-scale learning and networking platform. However, acquisition is the most realistic near to mid-term outcome.

Open Questions

There is a limit to the amount of research and time I can spend on this analysis. The following are open questions that would need to be explored through deeper market research, customer interviews, and product validation before making any investment decision.

Problem Statement

- What is the real willingness of consumers to pay for premium entrepreneurship education content?

- What is the true market size for founder education tools when accounting for regional and cultural differences?

- Is the primary problem educational (lack of startup training) or professional networking (lack of founder community)? Would pivoting to a LinkedIn-style social platform for entrepreneurs solve a more pressing need?

- If positioned as a social platform, whose problem are we solving - aspiring founders seeking community, existing founders needing networking, or investors looking for deal flow?

Product

- How effectively can AI generate scenarios that feel authentic and emotionally engaging to real founders?

- Can the product maintain long-term engagement without becoming repetitive or predictable?

- Could the gaming mechanics serve as the foundation for a professional networking platform, where completed scenarios become portfolio pieces and game interactions lead to real business connections?

- What would differentiate a founder-focused social platform from existing networks like LinkedIn, AngelList, or Founder Groups?

Market

- Will universities and accelerators adopt simulation-based learning at the pace and scale required for the business model?

- How will established players in business simulation and educational gaming respond to this market entry?

- Will corporate training budgets prioritise entrepreneurship simulation over other L&D investments?

- Is there sufficient unmet demand for a founder-specific professional network, or is the market already adequately served by existing platforms?

- How would network effects work in a founder-focused social platform - would early users attract others, or would it suffer from the "empty restaurant" problem?

Business Model

- Is the institutional sales cycle faster or slower than projected, and how does this affect runway and growth?

- How sensitive is the business model to economic downturns affecting educational and corporate training spending?

- What would be the revenue model for a LinkedIn-style founder platform - premium subscriptions, recruitment fees, event monetisation, or advertising?

- Could a social platform approach unlock larger revenue streams (recruitment, deal flow, premium networking) that dwarf the educational licensing model?

- Is there a way to combine the gaming/simulation core with social networking features, or do these represent fundamentally different value propositions that would confuse users?

Fundraising

- Can the founder successfully transition from technical leadership to the commercial execution required for B2B sales? The founder is actively interested in bringing in another co-founder to expand the team and complement their technical expertise.

References

- Academic Conferences. Analysing the Required Properties of Business Simulation Games.

https://papers.academic-conferences.org/index.php/ecgbl/article/download/3001/2650/10668 - PMC. Game-Based Learning and Gamification in Entrepreneurship Education.

https://pmc.ncbi.nlm.nih.gov/articles/PMC8829425/ - DemandSage. Startup Statistics.

https://www.demandsage.com/startup-statistics/ - Limelight Digital. Startup Statistics.

https://www.limelightdigital.co.uk/startup-statistics/ - Wikipedia. Startup India.

https://en.wikipedia.org/wiki/Startup_India - Times of India. Startup Policy to Create 1.3 Lakh Entrepreneurs in 5 Years Rolled Out.

https://timesofindia.indiatimes.com/city/mumbai/startup-policy-to-create-1-3-lakh-entrepreneurs-in-5-yrs-rolled-out/articleshow/123724429.cms - KNN India. Maharashtra Approves New Startup Policy to Create 1.25 Lakh Entrepreneurs, 50000 Startups in Next 5 Years.

https://knnindia.co.in/news/newsdetails/state/maharashtra-approves-new-startup-policy-to-create-125-lakh-entrepreneurs-50000-startups-in-next-5-years - Marketplace Simulations. Experiential Learning Simulations.

https://www.marketplace-simulation.com/ - NBEA Library. Marketplace Simulations Company Profile.

https://nbealibrary.org/company/marketplace-simulations - Marketplace Simulations. The Marketplace Game Review by Stan Shapiro.

https://www.marketplace-simulation.com/wp-content/the-marketplace-game-review-by-stan-shapiro.pdf - Virtonomics. Business Simulation Game Blog.

https://virtonomics.com/blogs/author/minvydas/ - Wikipedia. Markstrat.

https://en.wikipedia.org/wiki/Markstrat - ResearchGate. Analysing the Required Properties of Business Simulation Games to Be Used in

E-Learning and Education.

https://www.researchgate.net/publication/275784905_Analysing_the_Required_Properties_of_Business_Simulation_Games_to_Be_Used_in_E-Learning_and_Education - SAGE Journals. Entrepreneurship Education through Simulation Games.

https://journals.sagepub.com/doi/10.1177/2515127417737285